Scorpio Tankers: A 7.00% Baby Bond IPO From The Largest Monaco-Based Company

Scorpio Tankers (STNG) is an oil shipping company listed on the New York Stock Exchange, which has so far issued a total of 3 series of senior notes, all redeemed at their maturity date or a couple of months before. The last, Scorpio Tankers Inc. 6.75% Senior Notes due 2020 (SBNA) matured only 2 weeks ago, on 05/15/2020. Now the company enters the primary market again with a new series 5-year senior notes, detailed information about can be found downwards.

The New IssueBefore we submerge into our brief analysis, here is a link to the 424B5 Filing by Scorpio Tankers Inc. - the prospectus.

Source: SEC.gov

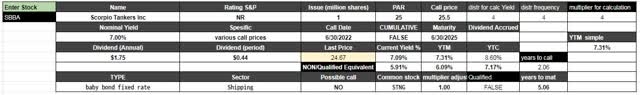

For a total of 1M notes issued, the total gross proceeds to the company are $25M. You can find some relevant information about the new baby bond in the table below:

Source: Author's spreadsheet

Source: Author's spreadsheet

Scorpio Tankers Inc. 7.00% Fixed Rate Senior Unsecured Notes due 2025 (NYSE: SBBA) pay a fixed interest at a rate of 7.00%. The new issue has no Standard & Poor's rating, it is callable as of 06/30/2022, and is maturing on 06/30/2025. The company has included some special optional redemption clauses depending on when the call occurs if such early call occurs before maturity:

- in the period between 06/30/2022 and 06/30/2023, STNG has the option to redeem the newly issued notes at a redemption price equal to 102% of the principal amount ($25.50),

- in the period between 06/30/2023 and 06/30/2024 - at a redemption price equal to 101% of the principal amount ($25.25), and

- in the period between 06/30/2024 and prior to maturity - at a redemption price equal to 100% of the principal amount ($25.00).

SBBA is currently trading a little below its par value at a price of $24.67 and has an 8.60% Yield-to-Call and a 7.31% Yield-to-Maturity. The interest paid by this baby bond is not eligible for the preferential 15% to 20% tax rate. This results in the "qualified equivalent" YTC and YTM sitting around 7.17% and 6.09%, respectively.

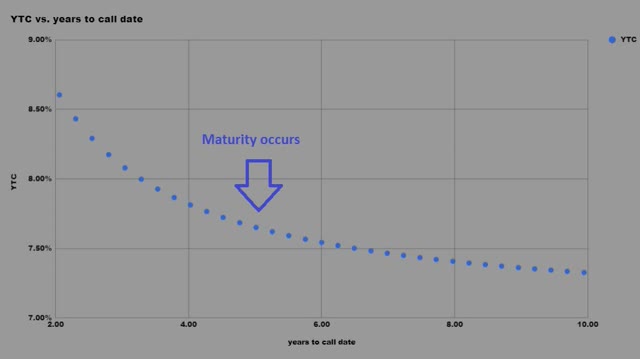

Here is how the stock's YTC curve looks like right now:

Source: Author's spreadsheet

Source: Author's spreadsheet

Scorpio Tankers Inc. (Scorpio Tankers) is a Monaco-based company active in the oil transportation industry. The Company is engaged on the seaborne transportation of refined petroleum products in the international shipping markets. Scorpio Tankers operates through four segments: Handymax, MR (Medium Range), Long Range 1 (LR1)/Panamax and Long Range 2 (LR2)/Aframax. Each of the Company's segments represents a different type of vessel with which it operates, with the total number of vessels being around 110. Handymax represents the smaller type of ship that the Company operates with, followed by MR, LR1 and LR2 being the biggest one. The Company operates with ships under its own ownership as well as finance leased or chartered-in.

Source: Reuters.com | Scorpio Tankers

Below, you can see a price chart of the common stock, STNG:

Source: Tradingview.com

Source: Tradingview.com

The 2020 Q1 and Q2 common stock dividends of $0.10 which means that the expected annualized payout of the common stock for 2020 will be $0.40. With a market price of $19.14, the current yield of STNG sits at 2.09%. As an absolute value, this means it pays $23.47M in dividends yearly.

In addition, with a market capitalization of around $1.15B, STNG takes place as a mid-sized Oil & Gas Midstream Company (according to Finviz.com). However, it is the largest of all Monaco-based companies listed on the NYSE.

Capital StructureBelow you can see a snapshot of Scorpio Tankers Inc.'s capital structure as of its Quarterly Report in March 2020. You can also see how the capital structure evolved historically.

Source: Morningstar.com | Company's Balance Sheet

Source: Morningstar.com | Company's Balance Sheet

As of Q1 2020, STNG had a total debt of $3.24B, and with the newly issued SBBA, the total debt of the company becomes $3.265B, that are senior to the company's equity. This makes the Debt-to-Market Cap ratio at 2.83, which is very unsatisfactory from the bondholder's point of view, meaning the company is highly leveraged and there is very limited market capitalization coverage.

Furthermore, from the income statement, we can see the company reported a loss in the past 4 years, $48.49M in 2019, $190.07M in 2018, $158.24M in 2017, and $24.90M in 2016. Last year when STNG came out to profit was in 2015, at a worth of $217.75M. The company's total net result for the last 5 consecutive years is a loss of $400.31M.

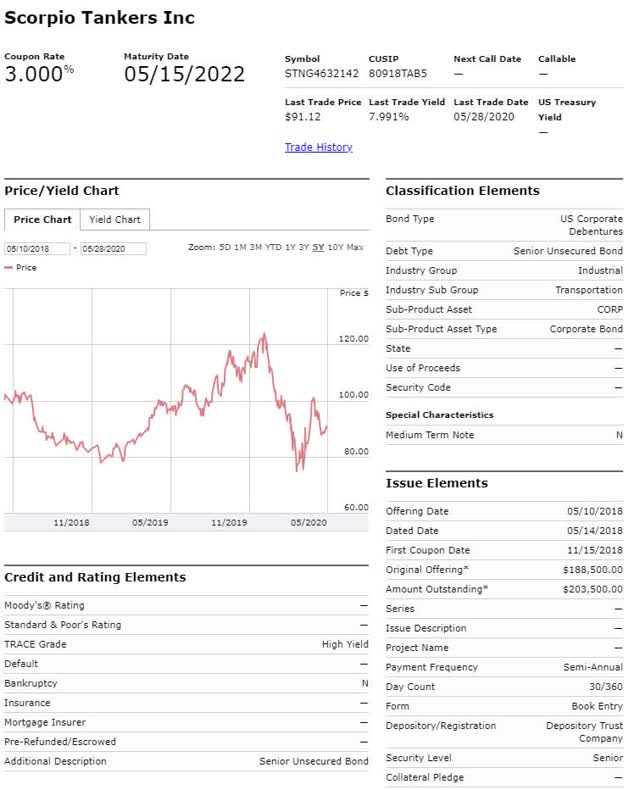

The Scorpio Tankers Corporate BondSTNG has one outstanding corporate bond:

Source: FINRA | STNG4632142

STNG4632142, as it is the FINRA ticker, is senior unsecured corporate bond. It is also not rated by any of the big three rating agencies and it is maturing on 05/15/2022, 3 years earlier from SBBA. With the current price of $91.12, it has a Yield-to-Maturity of 7.991%. When compared to the 7.31% Yield-to-Maturity of the newly issued baby bond, we can see a spread of 0.68% between the two securities in favor of the bond. If I have to choose one of the STNG's outstanding securities, I would definitely go with the corporate bond, as it has a shorter term to maturity, and returns almost 1% higher than SBBA. Yet, keep in mind that we are talking about a company that has been at a loss for the last 4 years.

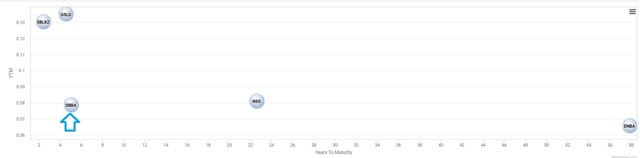

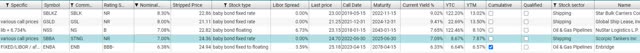

Sector ComparisonThe following section contains all baby bonds, with a par value of $25, issued by shipping or a midstream company. Except, the new IPO, there are four more issues in the sector, 2 fixed-rate, 1 floating rate, and a fixed-to-floating baby bond. Currently, all 5 "babies" are trading below their PAR, meaning their Yield-to-Worst will be their Yield-to-Maturity. Note the disadvantage of that the LIBOR related securities (NSS and ENBA) that are included in the comparison is their returns may deviate because of the LIBOR (SOFR after a year and a half) which practically may go to a negative value.

Source: Author's database

Source: Author's database

With its YTW of 7.31%, SBBA has the second-worst yield from the group, as only ENBA has lowest YTW. However, it is the only issue with an investment-grade rating and it is much further in terms of quality of the rest.

Source: Author's database

Source: Author's database

Fixed-Rated Baby Bonds

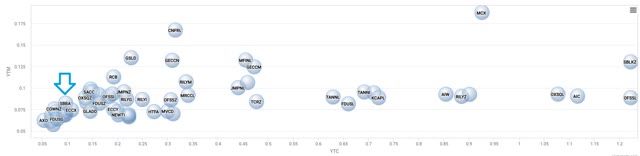

The next charts show a more global view of all baby bonds that trade on the national exchanges, pay a fixed distribution, and have stated maturity date of less than 10 years, with a positive YTC. For a clearer view, the baby bonds, issued by MDLY (MDLQ and MDLX) are excluded from the charts.

Source: Author's database

Source: Author's database

Source: Author's database

Source: Author's database

If a "Change of Control" occurs prior to June 30, 2022, the Issuer shall have the right to repurchase the Notes, in whole but not in part, within 90 days of the occurrence of the Change of Control, at a redemption price equal to 104% of the principal amount to be redeemed plus accrued and unpaid interest to, but excluding, the date of redemption, upon the occurrence of certain change of control events, as described under "Description of Notes⸻Optional Redemption Upon Change of Control."

Source: FWP Filing by Scorpio Tankers Inc.

Use of ProceedsWe intend to use the net proceeds of the sale of the Notes, which are expected to total approximately $23.8 million after deducting underwriting discounts and commissions and estimated offering expenses (but excluding a structuring fee as described in "Underwriting") (or approximately $27.4 million if the underwriters exercise their option to purchase additional Notes in full) for general corporate purposes and working capital.

Source: 424B5 Filing by Scorpio Tankers Inc.

Addition to the iShares Preferred and Income Securities ETFWith the current market capitalization of only $25M, SBBA cannot be an addition to the ICE Exchange-Listed Preferred & Hybrid Securities Index, thus it will not be included in the holdings of the main benchmark, the iShares Preferred and Income Securities ETF (PFF), which is important to us due to its influence on the behavior of all fixed-income securities.

ConclusionScorpio Tankers is the largest Monaco company listed in the US. But still, that doesn't mean it is not leveraged. On the contrary, its debt is almost 3x times more than the equity. Moreover, for the last 4 consecutive years, STNG records loss, as the total financial result for the last 5 years is a loss of $400M. If we look at the return of SBBA, it is yielding lower from the company's 2022 corporate bond, and also except the investment-grade ENBA, it is the lowest yielding issue in the sector. Things aren't different as regards to all baby bonds with a maturity up to 10 years, where the newly issued baby bond takes place at the bottom of the charts.

Trade With Beta Coverage of Initial Public Offerings is only one segment of our marketplace. For early access to such research and other more in-depth investment ideas, I invite you to join us at 'Trade With Beta.'Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Komentar

Posting Komentar